Transfer pricing is an important and often complicated issue faced by MNEs and this is because a transfer pricing policy can have a

significant effect on business profitability, taxes paid, shareholder value and a company’s overall risk management framework. MNEs are

required to manage transfer pricing in a world characterised by different taxation rates, different foreign exchange rates, varying

governmental regulations and in the context of increasing competition amongst revenue authorities for the lucrative tax revenue.

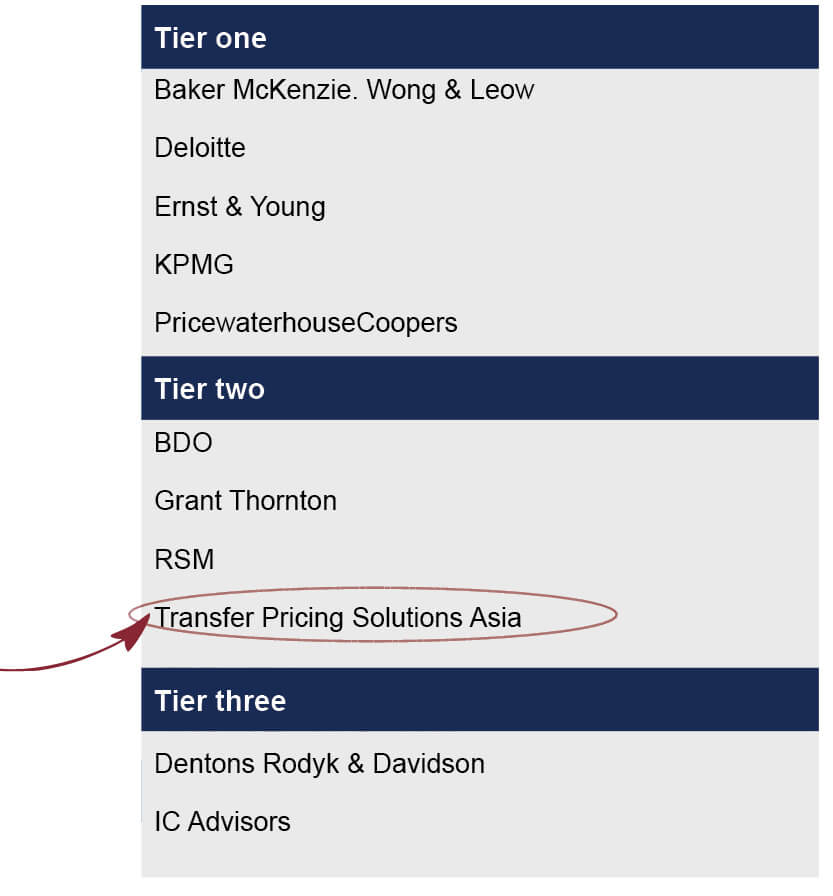

We are a boutique Tier 2 transfer pricing firm that partners with multinational firms and accounting firms, applying our experience and

expertise in transfer pricing to provide, prepare, document and assist in defending your international related party transactions.

In the linked pages below you will find detailed information on transfer pricing for Foreign Subsidiaries, for Singapore Regional HQ and

for Accounting Firms. We look forward to talking with you further to address any queries you may have.

This article will examine the challenges and opportunities that global minimum tax policies present for developing countries, including their potential impact on tax revenue and economic development.

Are your controlled transactions in line with the transfer pricing legislation? Mistakes in pricing will roll over from year to year. It is crucial to identify mispricing as soon as possible to better manager the transfer pricing risk.

A US multinational company with subsidiaries around the world, including Singapore, recently prepared new US transfer pricing documentation.

The company applies their transfer pricing policies on a global basis. The US tax director instructs the Singapore tax director to use this

documentation. Is the US documentation acceptable in Singapore?

We'd love to chat further. Please get in touch to discuss how Transfer Pricing Solutions can partner with you.

-for-TPS.png)