Singapore Transfer Pricing Update – 2023 IRAS’ Indicative margins for related party loan

Home • Insights • Singapore Transfer Pricing Update – 2023 IRAS’ Indicative margins for related party loan

Home • Insights • Singapore Transfer Pricing Update – 2023 IRAS’ Indicative margins for related party loan

below reflects the indicative margin for related party loans obtained or provided after 2022 that should be added to the new base reference rates (i.e., RFRs).

Table 1: Base reference rates for RFRs

| Period | Indicative Margin |

| 1 Jan 2022 to 31 Dec 2022 | + 180 bps (1.80%) |

| 1 Jan 2023 to 31 Dec 2023 | + 230 bps (2.30%) |

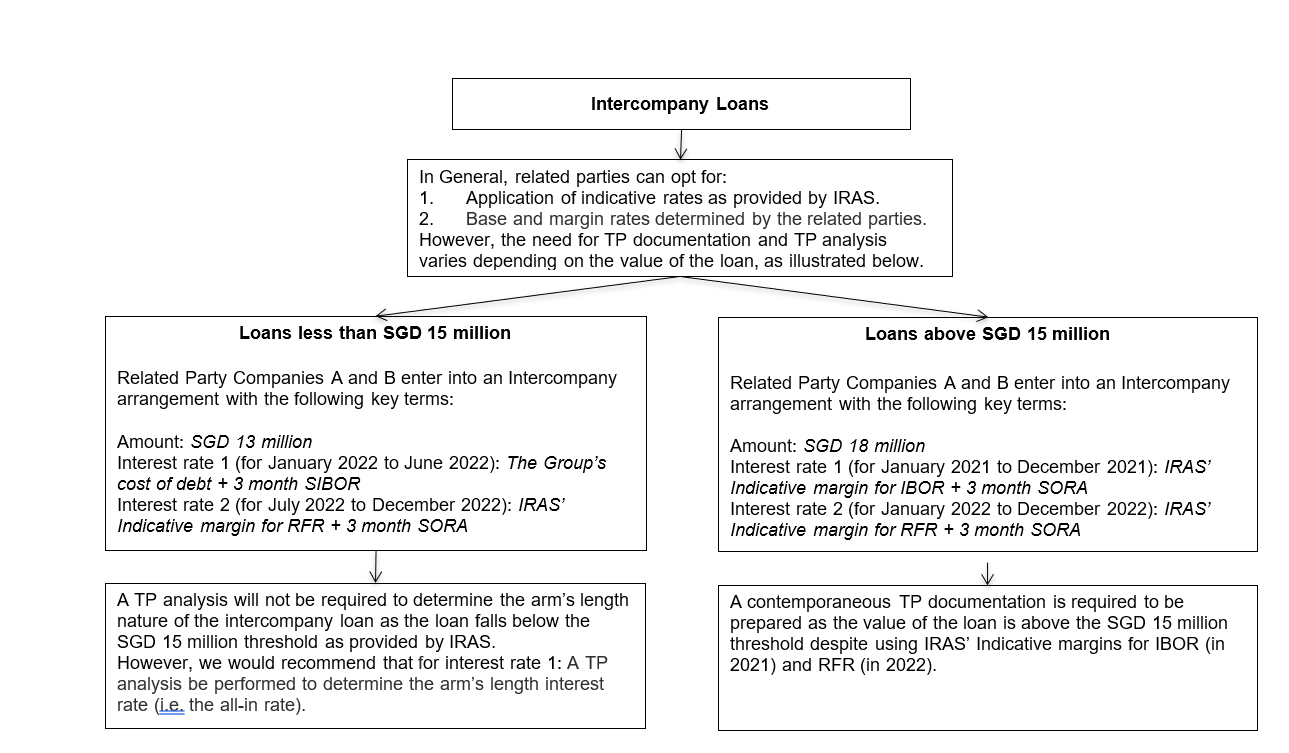

The following example illustrates how Taxpayers can use the indicative interest rate for intercompany loans.

Talk to our team of experts today.

| AUSTRALIA | +61 (3) 59117001 | reception@transferpricingsolutions.com.au |

| SINGAPORE | +65 31585806 | services@transferpricingsolutions.asia |

| MALAYSIA | +603 2298 7153 | services@transferpricingsolutions.my |

Our purpose is to make a difference in the service we provide to our clients by being practical, proactive and cost-effective.

Join us in this workshop as we delve into real-life case studies to share practical knowledge on managing transfer pricing in Singapore and the Asia Pacific region.