First Year of Singapore Mandatory Transfer Pricing Documentation, are you prepared?

Home • Insights • First Year of Singapore Mandatory Transfer Pricing Documentation, are you prepared?

Home • Insights • First Year of Singapore Mandatory Transfer Pricing Documentation, are you prepared?

In 2018, the Inland Revenue Authority of Singapore amended the Income Tax Act to enforce Mandatory Transfer Pricing Documentation for

Singapore Taxpayers. Is the new TP Documentation a real game changer?

In 2018, we facilitated about 15 transfer pricing workshops in Singapore with more than 300 attendees from different backgrounds and industries. The overall feeling was ‘uncertainty’ and ‘more compliance’.

One of the biggest challenges that we have observed for some taxpayers is that they have to prepare transfer pricing documentation for the first time as they have not thought about transfer pricing previously under the false assumption that the transfer pricing did not apply to them despite having intercompany transactions with Singapore and Non-Singapore related parties.

Other taxpayers (mainly subsidiaries) faced challenges around accessing transfer pricing documentation prepared by head office that they have not even seen in Singapore. For these taxpayers, they will need to request head office for the transfer pricing documentation prepared overseas and ensure that this document complies with Singapore’s transfer pricing legislation.

The good news is that to date, the Inland Revenue Authority of Singapore is not planning to update the transfer pricing guidelines in 2019.

Therefore, the current transfer pricing guidelines are applicable for Year of Assessment 2019 and 2020.

We have summarised in below the key changes and also ‘busted myths’ and misconceptions.

Transfer Pricing Documentation is not required in Singapore. True or False?

False!

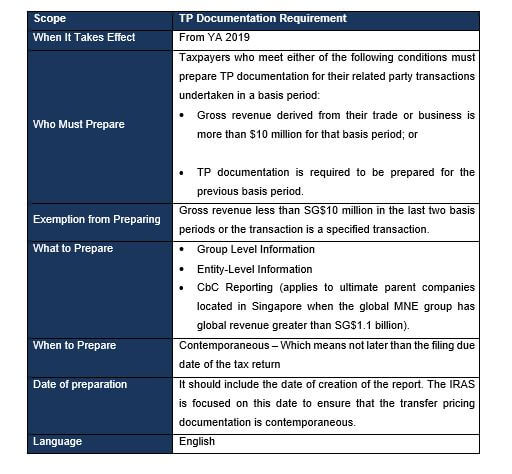

From the year of assessment 2019, taxpayers are required to prepare transfer pricing documentation under Section 34F of the Income Tax Act. In other words, transfer pricing documentation is mandatory in Singapore.

The obligation of preparing transfer pricing documentation applies to taxpayers who meet either of the following conditions:

Taxpayers that fall within either of the two conditions above can be exempted from the obligation if they are eligible for any of the two

available exemptions (1) Gross revenue less than SG$10 million in the last two basis periods or (2) the transaction is a specified

transaction. For the definition of specified transactions check paragraphs

6.18 of IRAS E-Guide to Transfer Pricing 5th Edition.

The arm’s length principle applies only to taxpayers that are required to prepare transfer pricing documentation. True or False?

False!

The arm’s length principle applies to all taxpayers in Singapore that entered into a controlled transaction as the arm’s length principle is in the Income Tax Act Section 34D and applies to all taxpayers that enter into controlled transactions.

Singapore has not implemented a Master File; Taxpayers in Singapore are only required to prepare local file information. True or False?

False!

Transfer Pricing Documentation in Singapore has to include two types of information (1) Group Level Information and (2) Entity-Level Information. These two types are broadly consistent with the Master File and Local File approach of the OECD as the Group Level information is broadly consistent with the OECD Master File and the Entity-Level information is broadly consistent with the OECD Local File.

Taxpayers in Singapore have to either request for the Master File prepared by Head Office to incorporate and complete the Group Level

information or prepare a Singapore Master File to comply fully with Singapore’s transfer pricing legislation.

Transfer Pricing Documentation has to be updated every year. True or False?

True, if there are significant changes in the business model and related party transactions.

False, if there are non-significant changes in the business model and related party transactions.

Singapore implemented a new concept under the name of ‘Qualifying Past Transfer Pricing Documentation’ whereby transfer pricing documentation can be valid for three years to avoid preparing one report for each financial year.

The transfer pricing documentation must comply with the following conditions to be valid for three years:

Key Changes

Questions?

Contact Transfer Pricing Solutions. We can assist with the preparation of transfer pricing documentation locally and regionally, Master File

and Local File to comply with the OECD and also local legislation.

Australia

+61 (3) 59117001

reception@transferpricingsolutions.com.au

Singapore

+65 31585806

services@transferpricingsolutions.asia

Malaysia

+ 603 2298 7153

services@transferpricingsolutions.asia

Contributed by our Director Adriana Calderon

Adriana is the co-founder of Transfer Pricing Solutions Asia and Transfer Pricing Solutions Malaysia and Lead Partner in Asia. Adriana has extensive international experience with Big Four and mid-tier firms advising multinational companies in the areas of corporate and international taxation across South America, the US, Australia and the Asia Pacific Region.

As a TP practitioner, Adriana has advised companies in the Asia Pacific Region across various industries and in a wide range of projects associated with planning, compliance and dispute resolutions with tax authorities.

Adriana also enjoys teaching and is a regular speaker and facilitator of Transfer Pricing seminars and workshops in Singapore. She is a transfer pricing trainer for the Institute of Singapore Chartered Accountants and Singapore Institute of Accredited Tax Professionals.

Adriana lives in Singapore with her family and is a mom of two energetic boys.