Final OECD Transfer Pricing Guidelines on Financial Transactions

Home • Insights • Final OECD Transfer Pricing Guidelines on Financial Transactions

Home • Insights • Final OECD Transfer Pricing Guidelines on Financial Transactions

WHAT ARE THE KEY CHANGES?

The Organisation for Economic Co-operation and Development (OECD) has released in February 2020 the final Transfer Pricing Guidance on Financial Transactions (Guidance). The Guidance provides an insight on the arm’s length treatment of various financial transactions among related parties.

With the Guidance in place, the OECD expects to see significant progress by multinationals in updating their existing transfer pricing policies on financial transactions to be in compliance with the Guidance.

The Guidance is divided into five main sections, including:

ACCURATE DELINEATION OF THE ACTUAL TRANSACTION

The delineation of the actual transactions is one of the key changes introduced by the OECD Guidance about loans. In the past, transfer pricing analysis will focus on the price. With this new requirement taxpayers are forced to first determine whether the loan is in nature a loan.

A transaction needs to be delineated in order to determine whether a loan can be regarded as a loan for tax purposes or whether it should be considered as some other kind of payment, such as a contribution to equity capital.

There are two key factors to delineate the financial transaction which are as follows:

The commercial or financial relations require an analysis on the factors affecting the performance of businesses in the industry sector such as the business or product cycle, effect of government regulations and availability of financial resources.

A multinational group’s policy provides the information on how a multinational respond to the identified factors. Some of the information provided in the policy include the funding needs between multinational group entities among different projects, strategic significance of a particular multinational within the multinational group, specific credit rating or debt-equity ratio and the different funding strategies than the one observed in the industry sector.

The economically relevant characteristics of actual financial transactions consist of the following:

With regards to the functional analysis, an overview is provided on the typical key functions performed by lenders and borrowers with respect to intra-group loans. The OECD Guidance highlighted that a related party lender may not perform all the functions at the same intensity as an independent lender. The Guidance also emphasised that risks should be allocated to the enterprise exercising control and having the financial capacity to assume the risk.

Characteristics of financial instruments include features and attributes such as amount of the loan, its maturity, the schedule of repayment, whereby these features and attributes should be documented accordingly.

The economic circumstances require detailed analysis on different currencies, geographic locations, local regulations, macroeconomic trends that are relevant to the financial transactions. As for contractual terms, it should be noted that the contractual terms of a loan transaction should align with the actual conduct.

INTRA-GROUP LOANS

When analysing the commercial and financial relations as well as the economically relevant characteristics of intra-group financial transactions, the perspective of both the lender and the borrower should be considered. With respect to the lender, it is important for the lender to evaluate the lender’s decision to grant the loan, the loan amount and terms, various other factors and the options realistically available. The borrower will need to carry out an assessment of the need for additional funds to meet its operational requirements and options realistically available for the borrower.

A credit assessment is normally conducted to identify and evaluate the risks involved and to consider methods of monitoring and managing these risks when entering into a loan transaction. The credit assessment includes understanding the business, purpose of the loan, how it is to be structured and the source of its repayment. Hence, commercial considerations such as creditworthiness, credit risk and economic circumstances should be considered when assessing the loan transaction.

The Guidance acknowledges that the creditworthiness of the borrower is one of the main factors considered by independent lenders whereby the credit rating of an entity is used to measure the creditworthiness of the entity. A credit rating which is based on quantitative and qualitative factors and can be determined by reference to the overall creditworthiness of a multinational group or on a stand-alone basis. It is important for an entity to document the reasons and selection of the credit rating.

With regards to credit rating, the Guidance highlighted that multinational group members with stronger links will have a credit rating that is more closely linked to that of the multinational group. Other hand, a member of the multinational group with limited to no implicit group support should consider the entity on the basis of its own stand-alone credit rating only.

Covenants are introduced to enable the limitation of risks in a given financial transaction. The two types of covenants that are available are incurrence and maintenance covenants. The incurrence covenants require or prohibit certain actions by the borrower without the consent of the lender. Maintenance covenants refer to financial indicators which have to be met at regular, predetermined intervals during the life of a covenanted loan.

One of the most important statements is in relation to bank opinion. According to the Guidance, bank opinions cannot be used as a benchmark as they do not represent the actual transactions entered by the borrower and lender.

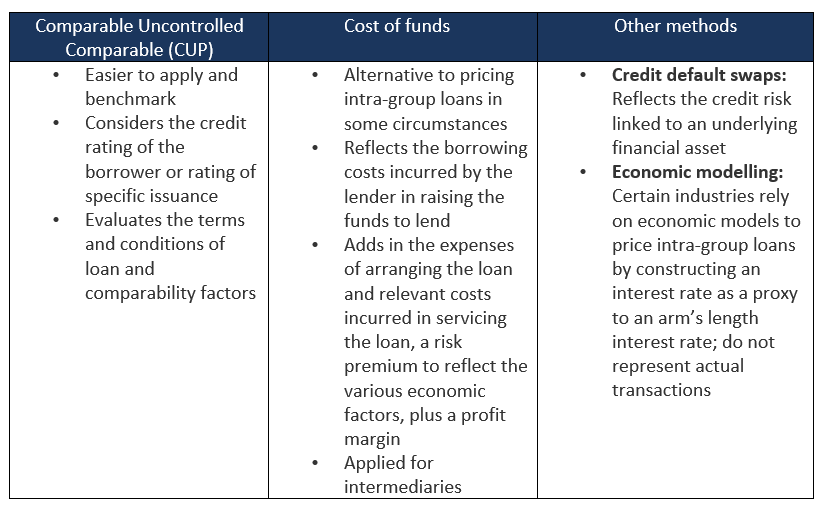

The following methods are suggested to determine the arm’s length interest rate of intra-group loans.

TREASURY FUNCTION

It is very common for multinational groups to centralise the treasury function within the group. The treasury function can be structured in two ways which are in decentralised and centralised form. The decentralised treasury function refers to instances where each operating entity of a multinational group handles its own financial transactions and receives limited support from the treasury entity whereas under the centralised structure, the treasury entity has full responsibility for funding and other related functions.

Some key functions of a treasury entity include centralising external borrowing of the multinational group, optimising liquidity, mitigating risk, raising debts and optimising cost of capital. Typically, a treasury function constitutes a support service to the main value-creating business operations. Therefore, the treasury entity is expected to receive an arm’s length fee for its coordination activities.

CASH POOLING

Cash pooling is arranged within a multinational group to ensure efficient cash management and achieve cost efficiency.

A cash pooling arrangement refers to the pooling of debit and credit balances of the separate bank accounts of cash pool members to arrive at a net balance. Interests will be paid or received based on the overall balance. The types of cash pooling include physical and notional pooling.

To determine an arm’s length remuneration for a cash pooling arrangement, it is important to identify:

A cash pool leader is remunerated depending on type of cash pooling arrangement and the activities performed by the cash pool leader. Typically, a cash pool leader performs no more than a co-ordination or agency function and therefore receives limited remuneration.

The reward for the cash pool members, on the other hand, is calculated through the determination of the arm’s length interest rates applicable to the debit and credit positions within the pool followed by the determination of the cash pool leader’s remuneration.

HEDGING

Centralised in a treasury entity, hedging is a means of transferring risk within the group by mitigating exposure to certain risks, such as foreign exchange or commodity price movements. It is provided that the hedging contract provided by one group member to other members may be seen as a service, which should be remunerated at arm’s length.

FINANCIAL GUARANTEES

A financial guarantee is defined as a legally binding commitment on the part of the guarantor to assume a specified obligation of the guaranteed debtor if the debtor defaults on that obligation. A financial guarantee is assessed based on the following factors:

Economic benefit: The economic benefit in relation to assessing a financial guarantee requires an initial consideration of the economic benefit beyond any passive association. A financial guarantee can affect the terms of the borrowing either by enhancing the terms of the borrowing or providing access to a larger amount of borrowing. A guarantee fee should only be paid to the guarantor if the guarantee helps in achieving better terms.

Effects of group membership: Any benefit arising from being part of a group (passive association) would not be seen as the provision of a service for which payment of a fee would be necessary.

Financial capacity of the guarantor: The financial capacity of a guarantor requires an evaluation of the credit rating of the guarantor and the borrower and the business correlations between them.

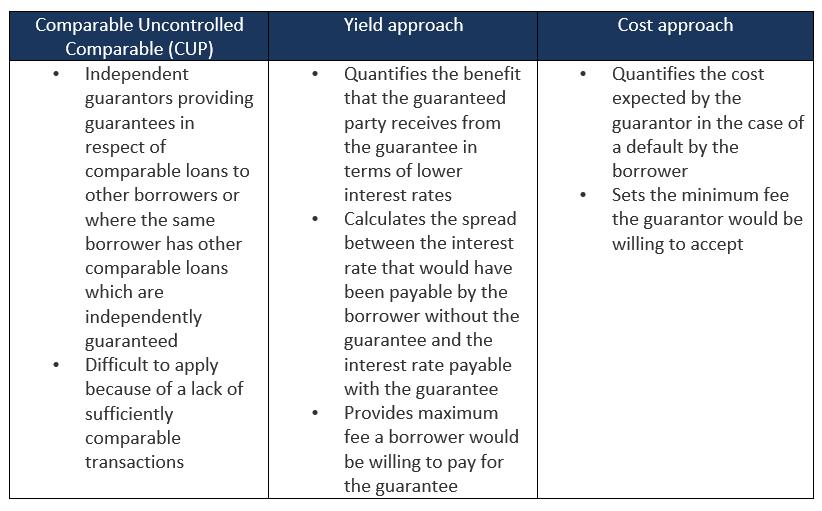

To determine the arm’s length price of guarantees, the following methods are suggested:

CAPTIVE INSURANCE

Captive insurance entities are defined as entities whose primary function is to insure risks of entities belonging to the same multinational group. In order to accurately delineate a captive insurance, it is important to determine whether the insurance is genuine, whether a risk exists and whether the risk is allocated to the captive insurance.

Some indicators of a genuine insurance are as follows:

As a captive insurance insures the risk and reinsures it in the open market, it should receive an appropriate reward for the basic services it provides. Any synergies created by a captive program may need to be shared among the multinational group entity.

RISK FREE AND RISK ADJUSTED RATES OF RETURN

A risk-free rate of return is applied when the funder lacks the capability, or does not perform the decision-making functions, to control the risk associated with investing in a financial asset. The funder’s cost of funding should be taken into account in determining such return. In order to determine the risk-free rate of return, reference can be made to certain government issued securities with the same functional currency and tenor.

The risk adjusted rate of return comprises two components namely the (i) risk-free rate and (ii) a premium reflecting the risks assumed by the funder. The methods that are applied when determining the risk adjusted rate of return are CUP and cost of funds.

Key Messages from the OECD

Contact Transfer Pricing Solutions. We can assist with the preparation of transfer pricing documentation locally and regionally, Master File

and Local File to comply with the OECD and also local legislation.

QUESTIONS

Australia | +61 (3) 59117001 | reception@transferpricingsolutions.com.au

Singapore | +65 31585806 | services@transferpricingsolutions.asia

Malaysia | +603 2298 7153 | services@transferpricingsolutions.my

Contributed by consultant Kaval Aulakh

Kaval works as a consultant for Transfer Pricing Solutions Australia, Transfer Pricing Solutions Asia and Transfer Pricing Solutions Malaysia. Kaval has more than five years of experience in various areas of transfer pricing assignments such as transfer pricing documentation, comparability studies, shared costs allocation and Mutual Agreement Procedure (MAP).

In her spare time, Kaval enjoys socialising, reading and playing badminton.

Contributed by Director Adriana Calderon

Adriana is the co-founder of Transfer Pricing Solutions Asia and Transfer Pricing Solutions Malaysia and Lead Partner in Asia.

Adriana has extensive international experience with Big Four and mid-tier firms advising multinational companies in the areas of corporate

and international taxation across South America, the US, Australia and the Asia Pacific Region. As a TP practitioner, Adriana has

advised companies in the Asia Pacific Region across various industries and in a wide range of projects associated with planning.

Adriana also enjoys teaching and is a regular speaker and facilitator of Transfer Pricing seminars and workshops in Singapore. She is a

transfer pricing trainer for the Institute of Singapore Chartered Accountants and Singapore Institute of Accredited Tax Professionals.

Adriana lives in Singapore with her family and is a mother to two energetic boys.