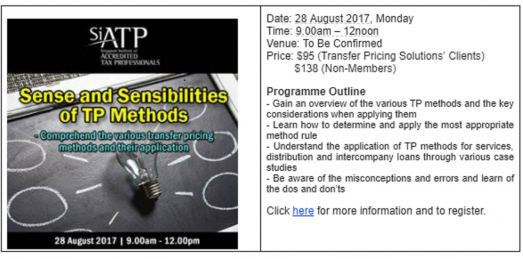

Sense and Sensibilities of TP Methods, Workshop Singapore, 28 August 2017

Home • Events • Sense and Sensibilities of TP Methods, Workshop Singapore, 28 August 2017

Home • Events • Sense and Sensibilities of TP Methods, Workshop Singapore, 28 August 2017

With transfer pricing being increasingly scrutinised, an area that companies and tax authorities may disagree is the correct application of the selected transfer pricing (TP) method. When challenged, companies have to demonstrate why and how the specific method was adopted.

In this session, Ms. Adriana Calderon, our director at Transfer Pricing Solutions Asia will share practical insights on the five common TP methods recognised by the OECD through various case studies.

Register for this session organised by the Singapore Institute of Accredited Tax Professionals and learn key tips to determine and apply the TP method that best suit the type of related party transaction.

Secure your seat NOW! The registration is open until 21 August 2017. A special discount applies to members of SIATP, ISCA, SICC, SMF and TPS Clients.

To register visit https://tinyurl.com/siatpevent-tp-methods.

For further enquiries about the event, please visit www.siatp.org.sg/events, contact Darrick at 6597 5719 / Nabila at 6597 5714 or email to enquiry@siatp.org.sg.Starting May 2026, in-scope multinational enterprise (MNE) groups must register for Singapore’s Multinational Enterprise Top-up Tax (MTT), Domestic Top-up Tax (DTT), and the GloBE Information Return (GIR) under the Multinational Enterprise (Minimum Tax) Act 2024.

For the year 2026, IRAS has updated its indicative margin, reaffirming its support for simplified, arm’s length transfer pricing practices.

Singapore taxpayers entering into financial arrangements with related parties must ensure compliance with the arm’s length principle. This includes transactions such as cash pooling, hedging, financial guarantees, captive insurance, and related party loans.