With the recent focus on profit shifting around the world, guidance on profit split method has revised by Organisation for Economic

Co-Operation and Development (“OECD”) in June 2018. OECD published the “Revised Guidance on the Application of the Transactional Profit

Split Method” under

Base Erosion Profit Shifting (“BEPS”) project - Action 10.

Profit split method (“PSM”) is one of the transfer pricing (“TP”) methodologies that is not so widely applied and always considered as the “last resort” method. However, is that true? If your company is applying or trying to apply PSM, do you really understand the purpose? Why is this applicable for your entity? How do you apply this TP methodology? What is the risk that you are facing and what do you need to be aware of?

In this article, we will provide an overview of PSM which clarifies some of the confusion.

One or more of the following indicators can indicate the need to consider the PSM:

Example

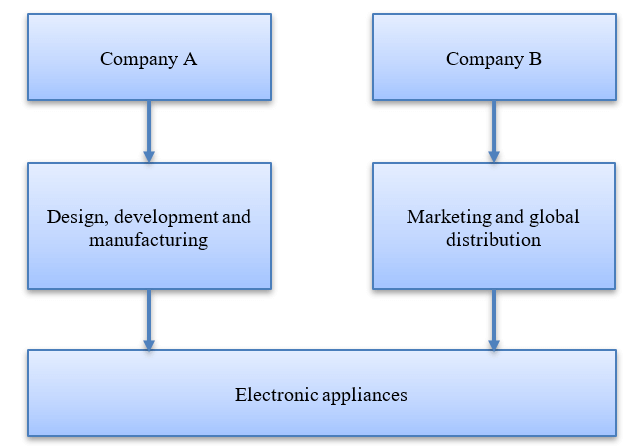

Company A and Company B are related parties operating under the same Group.

Company A is responsible for design, development and manufacturing of electronic appliances. Company B undertakes the marketing functions and the global distribution of the products.

Question:

Which method should we apply in this scenario? PSM?

Answer:

The answer is not PSM, IF there are no significant unique and valuable contributions made by both the companies. So, the KEY POINT is always refer to the three indicators in selecting PSM as the most appropriate TP method.

In this scenario, we would assume Company A develops valuable know-how and expertise, and uses it in the manufacturing activities.

The marketing activities performed by Company B has resulted in valuable trademark and associate goodwill. Company B also performed R&D activities related to the marketing activities and developed a sophisticated system to gather customer responses that is highly valuable.

Both companies have the authority for strategic decision making and bear the associated risks.

Under these circumstances, the PSM is likely to be the most appropriate method for determining the compensation for the products sold by Company A to Company B as both parties make unique and valuable contributions to the transaction.

Glossaries:

Unique and valuable

Highly integrated business operations

A high degree of integration means that the way in which one party to the transaction performs functions, uses assets and assumes risks is

interlinked with, and cannot reliably be evaluated in isolation from.

Shared assumption of economically significant risks, separate assumption of closely related risks

Various economically significant risks in relation to the transaction are separately assumed by the parties, but those risks are so closely inter-related and/or correlated that the playing out of the risks of each party cannot reliably be isolated.

Keep in mind:

A lack of comparables is, by itself, insufficient to warrant the use of the profit split method.

.jpg) Some of the firms treated PSM as the last resort when the other TP methodologies are not applicable or substantiating the substance of the

related party transaction. This is not appropriate as PSM should be selected based on the indicators and circumstances instead of the

availability of comparables.

Some of the firms treated PSM as the last resort when the other TP methodologies are not applicable or substantiating the substance of the

related party transaction. This is not appropriate as PSM should be selected based on the indicators and circumstances instead of the

availability of comparables.

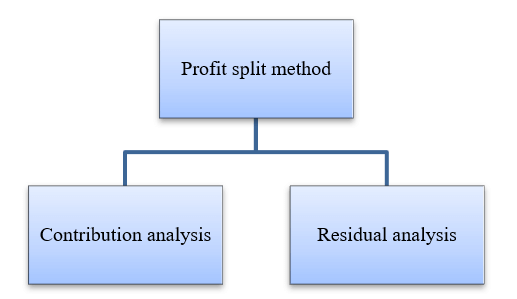

There are two approaches of PSM described below.

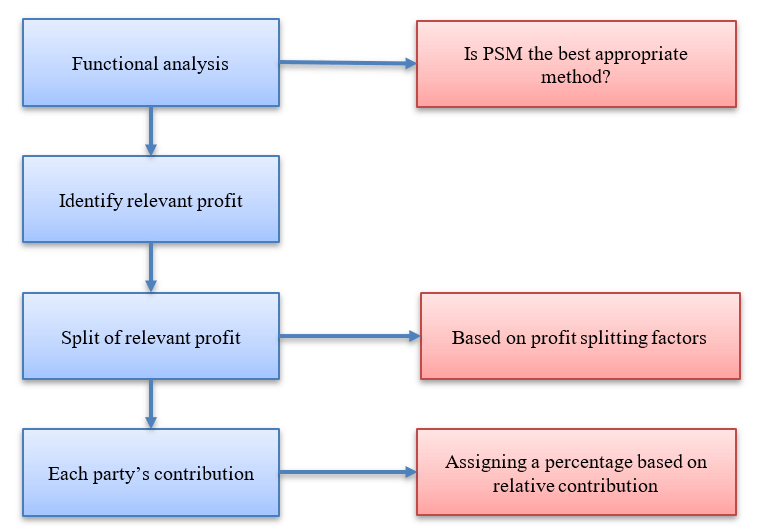

Contribution analysis

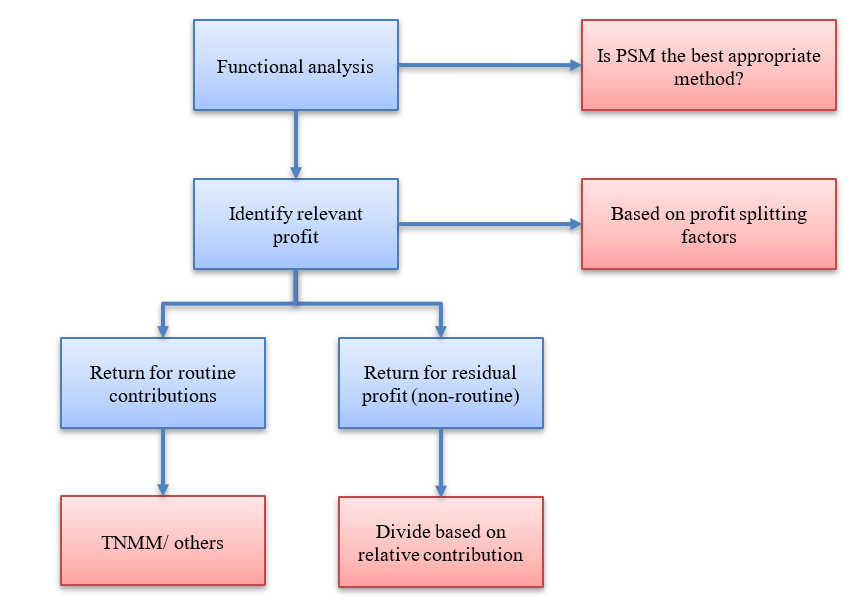

Residual analysis

Difficulties

It is challenging in profits split as it is subjective to determine the relevant profits to be split and what is the profit splitting factors.

We have compiled below the key tips in our experience that will help you to get your PSM right.

1. Identification of relevant profit

This is the first step involved in the PSM, hence it is important to get it right. In determining the relevant profits, it is therefore essential to first identify and accurately delineate the transactions to be covered by the transactional profit split method. The relevant income and expense amounts for each party in relation to those transactions will be determined.

2. Relevant profit to be split

Profits should be split on an economically valid basis that reflects the relative contributions of the parties to the transaction and thus approximates the division of profits that would have obtained at arm’s length.

The functional analysis and an analysis of the context in which the transactions take place (e.g. the industry and environment) are essential to the process of determining the relevant factors to use in splitting profits, including determining the weighting of applicable profit splitting factors, in cases where more than one factor is used. The determination of appropriate profit splitting factor(s) should reflect the key contributions to value in relation to the transaction.

Profit splitting factors can be based on:

Consideration

Internal data are essential to assess the values of the respective contributions of the parties to the controlled transaction. The determination of such values should rely on the functional analysis conducted with transfer pricing advisors (like Transfer Pricing Solutions) that takes into account all the economically significant functions, assets and risks contributed by the parties to the controlled transaction.

Questions?

Australia

+61 (3) 59117001

reception@transferpricingsolutions.com.au

Singapore

+65 31585806

services@transferpricingsolutions.asia

Malaysia

+ 603 2298 7153

services@transferpricingsolutions.my