The Iras Guidance To Transfer Pricing Part 2

Learning Centre • Insights • The Iras Guidance To Transfer Pricing Part 2

Learning Centre • Insights • The Iras Guidance To Transfer Pricing Part 2

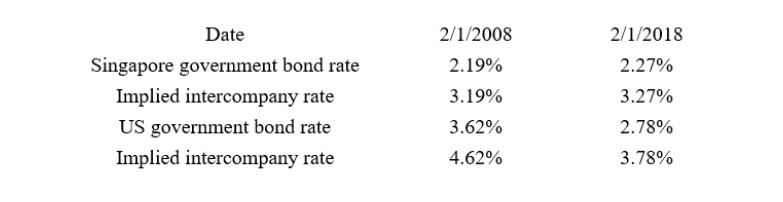

The following table represents the government bond rate for both nations for both February 1, 2008, and February 1, 2018. Even if the first intercompany loan were denominated in US dollars, the 8 percent intercompany interest rate would be quite high unless an analysis could support a credit spread near 4.4 percent.

If the intercompany loan were from a US parent to a Singapore subsidiary, the IRAS could argue that the 8 percent intercompany interest

rate on the first loan was excessive.

Alternative intercompany interest rates

Following the intercompany guarantee, the IRAS successfully argued that the credit rating for the Singapore borrowing affiliate was A so that the appropriate credit spread should be only 1 percent. The arm’s length interest rate also depends on the currency of denomination. If the intercompany loans were denominated in Singapore dollars, the arm’s length interest rate would be only 3.19 percent on the intercompany rate for the earlier loan. Refinancing, the intercompany interest for the loan issued on February 1, 2018, would be 3.27% since Singapore government bond rates were slightly higher than they were 10 years earlier.

Interest rates on 10-year US government bonds were 3.62 percent on February 1, 2008. If the appropriate credit spread were 1 percent, then

the corresponding arm’s length interest rate on the earlier intercompany loan would be 4.62 percent. When issuing the new intercompany loan

on February 1, 2018, the arm’s length interest rate would be only 3.78 percent since US government interest rates fell relative to 10 years

earlier.

The defense of the original 8 percent intercompany interest rate would become even more difficult if the Singapore borrowing affiliate were borrowing in US dollars instead of its original currency. With government bond rates being quite low since 2008 for many nations, intercompany interest rates could be much higher, depending on credit risk.