The Iras Guidance To Transfer Pricing Part 1

Learning Centre • Insights • The Iras Guidance To Transfer Pricing Part 1

Learning Centre • Insights • The Iras Guidance To Transfer Pricing Part 1

The improvement of Company X's credit rating from BBB to A is attributed entirely to passive support derived purely from its MNE group affiliation, which requires no active financial input from the parent company.

If IRAS had looked at the credit spreads of borrowers with A credit ratings, its Singapore subsidiary would have been able to borrow at an

interest rate of 3.25 percent. Since IRAS was aiming for the lowest weighted average cost of capital, its approach would have suggested an

intercompany guarantee fee of only 0.25 percent.

Paragraph 15.49 discusses the role of re-financing long-term loans. The first example assumes that the first loan was issued on February 1,

2008, with an interest rate of 8 percent. The guidance notes that the new loan would be issued on February 1, 2018, based on market rates in

early 2018.

The example does not specify which currency the intercompany interest rate was denominated in.

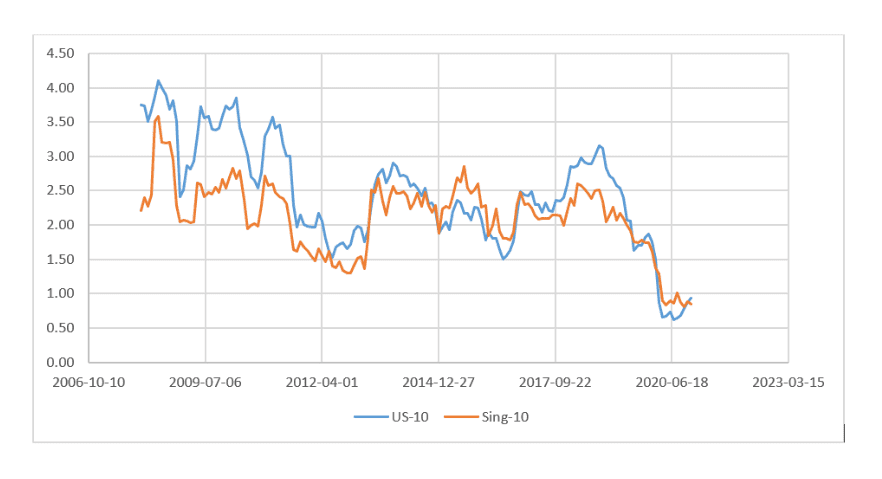

The following chart shows the evolution of 10-year government bond rates for both Singapore government bonds and US government bonds from

January 2008 to December 2020 where monthly averages are presented for convenience. Singapore government bond rates were generally lower

than US government bond rates in early 2008.

Over the next 10 years, both government bond rates fluctuated with US government bond rates being lower in early 2018 than they were in

early 2008. Singapore government bond rates in early 2018 were similar to the low government bond rates in 2008.